%20(1)_edited.png)

REIMAGINING SVB'S GLOBAL DIGITAL BANKING EXPERIENCE

Silicon Valley Bank is known as the gold standard for helping startups, VCs, and Private Equity clients navigate the unpredictable path to success through a deeply relationship-driven approach. However, SVB's online banking experience, a critical touchpoint that affects everything from service costs and client retention to reputation and acquisition, suffered greatly from multiple generations of conflicting design styles and an often antiquated user experience.

In 2014, SVB brought me in as Senior Director of User Experience, Research, Design to create their first design and research practice in order to reimagine and integrate their digital banking experiences and to make design thinking part of the bank's DNA.

During my time there, I built a team from scratch, set the working model with Product and Engineering, evangelized and educated partners on design thinking, brought in a great design agency to expand the design team's reach, created a road map to for revamping all digital experiences, and left SVB with an extensive design system upon which to build.

GRACEFULLY SCALING A CLIENT DASHBOARD

Our first project was to redesign the bank's mostly static dashboard which gave us an excellent crash course in the intricacies of SVB's wide array of clients. Ranging from early-stage clients with limited financial expertise, simpler needs, and lower volumes of accounts and transactions to corporate finance, VC, and Private Equity clients with complex financial structures, high volumes of accounts and transactions, and sophisticated treasury desks to manage it all and we were able to suss out what unites vs. differentiates them all in order to create a dashboard roadmap that would create a gracefully scaling client dashboard regardless of segment, user role, or behavior pattern.

We prioritized early-stage clients first, combining internal research via SMEs, stakeholders, and segment experts with client interviews to ensure we didn't rest on our internal perspectives and had a crisp vision of the user needs in their own words. First-time entrepreneurs did not love having to do commercial banking and expected SVB to provide an experience that would be seamless and easy. In short, they wanted a commercial banking experience with an approachable, consumer feel.

We focused on designing a simple payment initiation flow, presenting account balances in an easier to scan fashion, using friendlier language to replace more formal and potentially confusing banking terminology, adding in-context support to clarify things like payment cut-off times or the difference between current and available balance. We also created a system of reminders to help approvers know when a payment cut-off time was coming up and how to deal with a payment that had missed its cut-off time, both a consistent source of calls to Client Service.

Other opportunities to help clients self-serve included making critical payment tracking information like Fed Reference and SWIFT numbers available front and center. This decreased calls to client service and saved users from having to click several layers deep to pull a report in order to track payments.

After releasing to our early-stage audience, we needed to scale for audiences much further along in their financial maturity and complexity. Where the early stage audience wanted their experience simplified and consumer-like, the later stage companies, VCs, and Private Equity firms were largely finance professionals who wanted their experience to be robust, not "dumbed down," and attuned to their more sophisticated needs.

Our research showed that in order to serve these clients well, the dashboard need to scale gracefully to handle hundreds of accounts and potentially hundreds of transactions in flight at any given moment, to do a better job of displaying a multiple currency mix of account balances, and to allow users to personalize their view of accounts and the order of elements on the page to best fit an individual's role in the company.

The multi-year project culminated with all clients migrating to a single, unified, global homepage, ending the cost of a prolonged period of design, product, and engineering having to maintain three separate ones. Additional benefits included:

-

Clients reported that the new homepage made researching transactions so much faster, that the customization features finally gave them a view of their accounts that was far more useful than an arbitrarily truncated view, and that having the flexibility to approve all transactions or just pick and choose from everything in their queue right from the homepage saved time and headache for approvers who really just need to do that one task.

-

Calls related to repetitive low-level services issues like identifying a Federal Reference number to track payments decreased.

-

The foundation was laid for SVB's first responsive design.

-

SVB teams participating directly in the full, end-to-end user-centered design process for the first time.

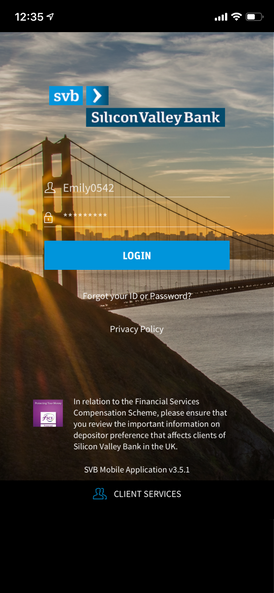

REFRESHING A DATED MOBILE APP

Working without our external design agency and partnering with our mobile product management team, we pushed for budget to redesign SVB's mobile app. Client satisfaction with the app's functionality was rated fairly high, but the experience was dated and represented yet another generation of design. Because we had performed a complete visual redesign with this agency, they were able to make quick work of refreshing the mobile app and fixing some critical usability issues like better filtering to find accounts and transactions and a streamlining a unified flow of making payment approvals and rejections. We tested the experience with clients using Marvel and Proto.io, which constituted the first internal mobile research performed on a device rather than a simulator, gave us a strong indication of high satisfaction with the redesign and set a new process by which future mobile studies could be done with better accuracy.

THE JOURNEY TOWARD "MOVE MONEY"

Our explorations of payment experiences led us closer and closer to a "Move Money" concept over time. I want to pay this person, on this day, this amount of money and I want the best payment type and cost options to be automatically shown based on my input. Whatever burden we could remove from a client to have to remember all the rules of domestic or international banking, the more we could passively educate clients and reduce their microdecision load. Our research showed that making payments was stressful for clients because errors can be difficult to address once a payment goes out. Reducing their decision load was critical to preventing entry and selection errors that couldn't already be avoided by ensuring the payment form had strong validation. From a servicing perspective, we also wanted to give clients as much transparency into the factors that make a successful payment embedded into the flow. Account balance information to avoid overdrafts and auto-calculated payment cut-off times and ETAs were two ways to satisfy the transparency need and would help reduce client service calls.

Efforts toward this vision are in progress and can't be displayed here, but the inspiration concepts are below.